Market Briefs | July 8, 2025

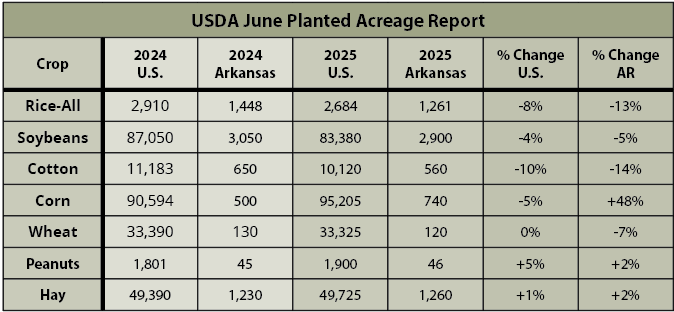

USDA June Planted Acreage Report

On June 30, 2025, USDA released its annual Acreage Report. The wet spring is reflected in the Arkansas numbers, with rice, soybean, and cotton acreage significantly lower than a year ago. Arkansas farmers planted 7.053 million acres in 2024 and are expected to seed only 6.887 million acres in 2025. That’s down 166,000 acres, or 2.4% year over year. The report is based upon farmer surveys conducted between May 30 and June 16 and in some cases reflect acres left to be planted, so additional cuts to the acreage totals could come in future reports.

Rice

Rice futures are trending sharply lower, under pressure from bearish world fundamentals. India has large stockpiles of rice and are expected to produce a big crop in 2025 and are working to move that through the market with record-setting export totals. That is ultimately resulting in lower world prices and pressuring U.S. prices. U.S. acreage is projected to be down 8% from a year ago, and the crop got a rocky start. Crop conditions are improving, though, and 67% of the Arkansas crop is now rated good to excellent.

Corn

Corn futures began the week on a negative note by gapping lower and erasing pre-holiday gains. Old-crop July is in position to test support at the recent low of $4.08 and new-crop December set a new low of $4.13 ¼. The U.S. crop has good yield potential, with 74% of the crop in good to excellent condition. Global trade prospects are the driving factor for corn, too, with the lack of trade deals and high tariffs looming large over the markets.

Soybeans

Soybean acreage is expected to be down 4% year over year, but the market is having trouble building upward momentum. November failed last week at $10.58 1/2 and the market gapped lower to test support at $10.13. A close below that level could signal a retest of the April low of $9.71 ¼. The market is worried about export prospects, as China has yet to commit to purchase any soybeans from the U.S. in 2025-2026. The lack of a trade deal with China has the market on edge, especially considering the large supplies of Brazilian soybeans on the market.

Cotton

Sharp declines in cotton prices have not had much impact on futures prices. U.S. acreage is projected to be down 10%, but the crop is in relatively good shape with better than average yield prospects. 52% of the crop is in good to excellent condition nationwide.

The Arkansas crop, however, is looking a little worse than usual, with 58% in good to excellent condition. Futures continue to trade in a mostly sideways range. December has resistance at 69.5 cents and support at 66.5 cents. The market remains under pressure from weak export prospects and uncertainty about global trade and tariffs.

Livestock

Live cattle futures came back strong after the holiday weekend. August set a new record-high of $220.25. Strong wholesale beef prices and futures’ discount to cash prices are all supportive. Feeder futures are also soaring, setting new all-time highs for August at $319.45 and October at $317.55. Weaker corn prices and expectations for a large crop are supportive. Hog futures are looking toppy after trending sharply higher since April. The October contract has resistance at the recent high of $97.575 and is trading in a mostly sideways pattern.